http://baselinescenario.com/2009/04/19/more-accounting-games/The New York Times is reporting that the administration is thinking of stretching its TARP funds further by converting its preferred shareholdings to common stock.

The change to common stock would not require the government to contribute any additional cash, but it could increase the capital of big banks by more than $100 billion.

I hope this is one of those trial balloons they float and later think better of. Most importantly, it makes no sense. That is, there’s nothing fundamentally wrong with converting preferred for common, but it doesn’t create anything of value out of thin air. I wrote a long article about preferred and common stock a while back, but here are some of the highlights.

* If you don’t give a bank any more money, it doesn’t have any more money. By converting preferred into common, you haven’t changed the chances of the bank going bankrupt, because its assets haven’t changed, and its liabilities haven’t changed. If it had enough money to cover its liabilities, but it couldn’t buy back its preferred shares from Treasury, it’s not like the government would have forced it into bankruptcy anyway.

* If you accept the idea that converting preferred into common creates new capital, then you are implying that those preferred shares weren’t capital in the first place. From a capital perspective, then, the initial TARP “recapitalizations” did nothing, and nothing happens until the conversion. You can’t say that JPMorgan got $25 billion of capital last fall and it’s going to get another $25 billion now just by virtue of the conversion.

* Tangible common equity and Tier 1 capital are just two ways of measuring the health of a bank. Taking money that wasn’t TCE and calling it TCE doesn’t serve any economic purpose. There is a minor benefit to the bank because now it doesn’t have to pay dividends on the preferred. But otherwise you’ve just shuffled together the claims of the last two groups of claimants - the preferred and the common shareholders. You’ve made things look better from the perspective of the common shareholders as a group, because they no longer have preferred shareholders standing in front of them, but the total amount available to all shareholders hasn’t changed.

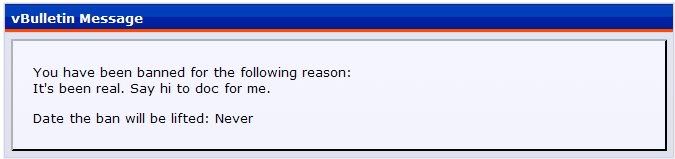

And no, it's not a trial balloon. It's what's going to happen.

Glad to see the trickery and games of the Bush years has gone by the wayside.