Fuck the bankers

Posted: Fri Jan 23, 2009 3:48 pm

Don't know if this fits here or in the financial forum better...it's relevant to both....definitely airing a big grievance I have here:

And of course, the drumbeat has begun in earnest for the nationalization of the entire banking system. What people don't realize is that if we nationalize, it will be done poorly and we will be left with zombie banks just like Japan. Look at the government's track record so far in handling this crisis--the ineptitude speaks for itself loud and clear. The market has spoken:

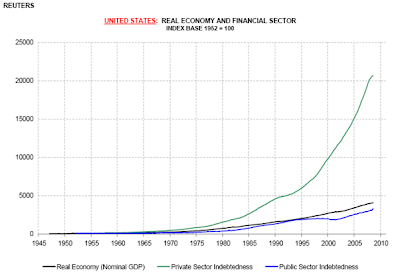

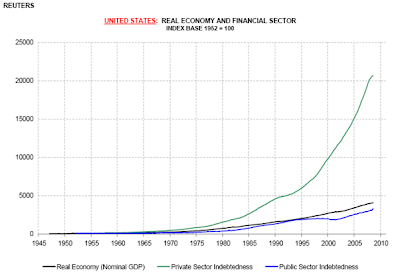

And the market has told us: The banks have run themselves right out of business. They got waaaaaaaaaaaay too greedy, to the point where we have ZERO chance, IMO, to continue feeding the debt monster they created, even if we do nationalize them:

(last 2 charts from Mish at http://globaleconomicanalysis.blogspot.com/)

That level of debt simply isn't sustainable given current capacity and demand. The funny thing is our government has even been more responsible than the fraudulent banksters (who are stealing from us all), which is a laughable concept. Think about how we all see the national debt--we probably think it's a little crazy and damn sure risky as hell in the long run, at the very least. The national debt is 11.5 times higher than it was in 1975, which seems like a large expansion...but the total PRIVATE debt is 22 times higher than it was in 1975. So the banks have gone nearly TWICE as far pushing the envelope than the government. In short, they don't deserve to be saved. And even if we wanted to save them, they would be zombie banks for probably a minimum of 6-8 years, basically useless as financial institutions.

But let's go ahead and give them $350 billion more now...then in a few months, spend God knows how much nationalizing the whole damn corrupt, fraudulent system! :

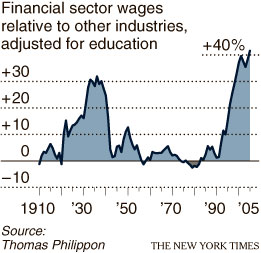

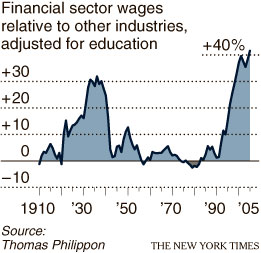

http://www.nytimes.com/2009/01/23/business/23norris.html?_r=1It is one thing when the best-paid people seem to be the smartest and the most accomplished. Those who make much less may not like it, but the differential seems understandable. It is another thing when those people are shown to have committed huge blunders that would have driven their companies out of business, and them into the unemployment line, but for government bailouts.

And of course, the drumbeat has begun in earnest for the nationalization of the entire banking system. What people don't realize is that if we nationalize, it will be done poorly and we will be left with zombie banks just like Japan. Look at the government's track record so far in handling this crisis--the ineptitude speaks for itself loud and clear. The market has spoken:

And the market has told us: The banks have run themselves right out of business. They got waaaaaaaaaaaay too greedy, to the point where we have ZERO chance, IMO, to continue feeding the debt monster they created, even if we do nationalize them:

(last 2 charts from Mish at http://globaleconomicanalysis.blogspot.com/)

That level of debt simply isn't sustainable given current capacity and demand. The funny thing is our government has even been more responsible than the fraudulent banksters (who are stealing from us all), which is a laughable concept. Think about how we all see the national debt--we probably think it's a little crazy and damn sure risky as hell in the long run, at the very least. The national debt is 11.5 times higher than it was in 1975, which seems like a large expansion...but the total PRIVATE debt is 22 times higher than it was in 1975. So the banks have gone nearly TWICE as far pushing the envelope than the government. In short, they don't deserve to be saved. And even if we wanted to save them, they would be zombie banks for probably a minimum of 6-8 years, basically useless as financial institutions.

But let's go ahead and give them $350 billion more now...then in a few months, spend God knows how much nationalizing the whole damn corrupt, fraudulent system! :