Page 1 of 1

bernanke just said this has NO comparison to the Great Depression of 1929

Posted: Mon Dec 01, 2008 2:32 pm

by radbag

said it at a luncheon addressing business leaders in austin texas today

- we don't have 30% unemployment

- we don't have over 90% of our financial institutions failing

- we have a proactive federal reserve

said 'put ideas of comparing this to the great depression out of your minds'...'as a scholar of the great depression, what we are experiencing now has no comparison....................'having said that, we've cut 100 basis points in the month of october...things are tough out there'

bernanke just said this has NO comparison to the Great Depression of 1929

Posted: Mon Dec 01, 2008 2:58 pm

by MinGator

sounds like he's talking out of both sides of his mouth.

bernanke just said this has NO comparison to the Great Depression of 1929

Posted: Mon Dec 01, 2008 3:06 pm

by radbag

you have to gman...you have to.

it's not being a snake or anything...it's about acknowledging both sides of the discussion...clearly though, he was adamant about this crisis coming nowhere near the one that occurred in 1929

bernanke just said this has NO comparison to the Great Depression of 1929

Posted: Mon Dec 01, 2008 3:21 pm

by annarborgator

I understand Bernanke's position given current conditions, but we have to remember that we are still working our way through some major issues. The GD didn't hit all at once in a massive collapse of everything with food lines showing up the very next day. It took years to play out.

Years. To prematurely conclude we are out of the woods could be catastrophic...of course, behind closed doors, I'm sure Bernanke has some idea of the issues we still are going to have to work through, such as:

1. You can't force households or businesses to borrow more money and spend it. Japan's central bank has flooded that nation with liquidity and low interest money for 19 years to little effect.

2. U.S. consumers and corporations are already burdened with staggering debt. Not only can't you force people to borrow more, you also can't force lenders to loan more money to insolvent households and businesses.

3. Whatever money people get their hands on is going to paying down debt and savings. Studies of the first "stimulus package" checks which went out to taxpayers in 2008 revealed that 2/3 of the money was not spent but used to service debt or saved. Future "stimulus checks" will also fail to boost spending; people already have more stuff than they know what to do with.

4. The FIRE economy is dead. Finance, insurance and real estate (FIRE) all prospered for one reason: the velocity of transactions and debt instruments. With the volume of transactions off by 2/3 (real estate) or 99% (home equity loans), the FIRE economy is shrinking fast, with no barriers to further declines. With lending standards rising even as real estate values plummet, there is nothing to stop transaction and debt velocity from falling much further.

5. Governments and corporations alike are living with Fantasyland expectations of revenue. I recently pored over the 2009 fiscal year budget of my town of 120,000 people (general fund spending is $135 million, which doesn't include capital projects or bond-funded spending) and was dumbstruck by the insanely unrealistic revenue expectations.

6. If lenders make risky loans, they will go under--and most U.S. households and businesses are no longer creditworthy risks. So there you have it: This conflict cannot be resolved. Lenders who foolishly extend credit to over-indebted, risk-laden borrowers will be paid back with losses and insolvency, yet as lending standards tighten and assets plummet in value, the number of creditworthy borrowers in the U.S. has shrunk.

7. The U.S. already has too much of everything: too many hotels, malls, office towers, homes, condos, strip-malls, lamps, furniture, CDs, TVs, clothing, etc. As 50 million storage lockers filled to capacity with consumer crap are emptied in a desperate move to reduce expenses and raise cash, the value of literally everything ever manufactured will fall to near-zero.

http://www.financialarmageddon.com/2008/11/gone-over-toast.html

So yes, this doesn't compare to the GD.

Yet. That's an important caveat, IMO. I'm not cheerleading for a depression, just pointing out differing views in the interest of truth...only time will tell.

He's definitely right in that the Fed (and Treasury for that matter) has already been MUCH more aggressive in dealing with the situation. Hopefully their actions will be enough to work this all out.

bernanke just said this has NO comparison to the Great Depression of 1929

Posted: Mon Dec 01, 2008 3:30 pm

by radbag

i don't disagree wes. yet is the key word...having said that, eric the other day thought we were in a depression and i tried my best to explain that these things just don't happen overnight...this has been at least 24 months in the making.

bernanke, a scholar on the subject, said the depression ended after 12 years...it took a world war to get us back on our feet.

bernanke just said this has NO comparison to the Great Depression of 1929

Posted: Mon Dec 01, 2008 4:59 pm

by G8rMom7

Rad, I totally agree with you...it's almost impossible to compare the current situation to the GD. I mean people stand in line for hours for a Blackberry...not bread. It may be bad and I'm inclinded to compare it to 87 okay...maybe it's worse than 87. But it's not the GD. And I will go so far as to say I don't think it will get that bad...I just don't see how it could. But I'm not as smart as all of you, so what do I know?

bernanke just said this has NO comparison to the Great Depression of 1929

Posted: Mon Dec 01, 2008 5:10 pm

by radbag

hey - you bring a lot to the table...you're a homeowner, you're a small business, you're a child of persons who are retired (or close to it)

your opinion and views are what analysts on wall street strive to understand.

bernanke just said this has NO comparison to the Great Depression of 1929

Posted: Mon Dec 01, 2008 5:34 pm

by annarborgator

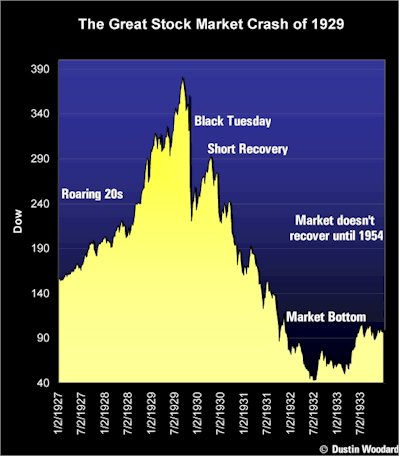

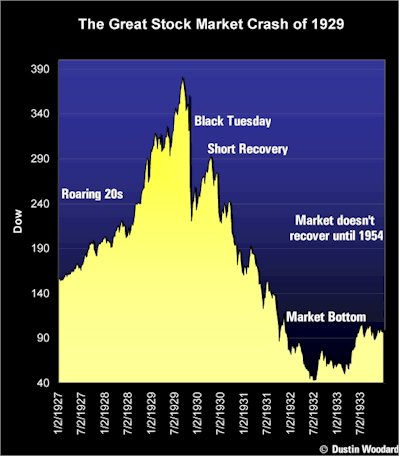

Couple things...first, this chart is helpful to recognize the period of time we're talking about for the GD...it's helpful, I think to see the shortterm bottom found after the initial crash, followed by the subsequent persistent deflation:

And wikipedia's explanation also illustrates how these fundamental issues take time to work their way to the surface of the economy:

The Great Depression was not a sudden, total collapse. The stock market turned upward in early 1930, returning to early 1929 levels by April, though still almost 30 percent below the peak of September 1929.[7] Together, government and business actually spent more in the first half of 1930 than in the corresponding period of the previous year. But consumers, many of whom had suffered severe losses in the stock market the previous year, cut back their expenditures by ten percent, and a severe drought ravaged the agricultural heartland of the USA beginning in the summer of 1930.

In early 1930, credit was ample and available at low rates, but people were reluctant to add new debt by borrowing. By May 1930, auto sales had declined to below the levels of 1928. Prices in general began to decline, but wages held steady in 1930, then began to drop in 1931. Conditions were worst in farming areas, where commodity prices plunged, and in mining and logging areas, where unemployment was high and there were few other jobs. The decline in the American economy was the factor that pulled down most other countries at first, then internal weaknesses or strengths in each country made conditions worse or better. Frantic attempts to shore up the economies of individual nations through protectionist policies, such as the 1930 U.S. Smoot-Hawley Tariff Act and retaliatory tariffs in other countries, exacerbated the collapse in global trade. By late in 1930, a steady decline set in which reached bottom by March 1933.

bernanke just said this has NO comparison to the Great Depression of 1929

Posted: Mon Dec 01, 2008 6:57 pm

by G8rMom7

hey - you bring a lot to the table...you're a homeowner, you're a small business, you're a child of persons who are retired (or close to it)

your opinion and views are what analysts on wall street strive to understand.

My parents have been retired for quite some time. My dad moved 80% of his savings to cash thankfully before all the hullabaloo, so he didn't lose everything.

Bill is pretty secure with his business...we don't anticipate it growing as much as we hoped, but at least he's been pretty steady...so far, football doesn't look like it's going anywhere.

Disney is definitely affected by all this...the company lost a lot with the Lehman Bros. debacle. Hopefully though we are more diverse than we used to be back in 87 (TV network, Cable networks, mobile, consumer products, etc. in addition to our parks, movies and such) that we'll make it through. There have been some layoffs in my area but it's mostly one of those things where you now have an easy-out to get rid of the dead wood. It's usually quite hard to get rid of someone at Disney but in times like these, it's a good excuse.

In any case, I am a marketer's dream. We have a decent income, good credit and are on the hunt for good deals.

bernanke just said this has NO comparison to the Great Depression of 1929

Posted: Mon Dec 01, 2008 7:32 pm

by annarborgator

rad, I forgot to mention previously....I definitely agree that deflation isn't always a bad thing...prices coming back to earth can be a boon to the future business cycle, so long as the money supply isn't wrecked in the meantime. To wit:

NEW YORK (Reuters Life!) - A cocktail born of the Great Depression may be just the tonic for New Yorkers worried about the economy.

To mark the 75th anniversary of the Bloody Mary U.S. restaurant chain TGI Friday's is selling the drink at 1933 prices -- 99 cents each at its New York restaurants.

http://in.reuters.com/article/entertainmentNews/idINIndia-36812420081201

Cheers!